Navigating the Market Landscape: Understanding the Nasdaq Heatmap

Related Articles: Navigating the Market Landscape: Understanding the Nasdaq Heatmap

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Market Landscape: Understanding the Nasdaq Heatmap. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Market Landscape: Understanding the Nasdaq Heatmap

The financial world is a complex and dynamic ecosystem, constantly shifting and evolving. For investors, navigating this landscape requires tools that provide clear and concise insights into market trends. One such tool, widely used by traders and analysts, is the Nasdaq Heatmap.

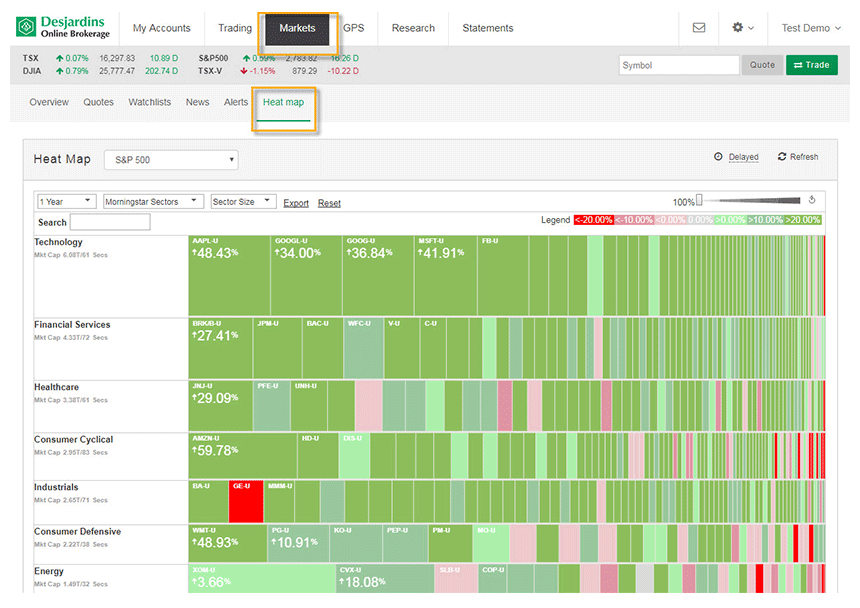

The Nasdaq Heatmap is a visual representation of market activity, displaying the performance of stocks listed on the Nasdaq Stock Market. It offers a powerful snapshot of the market’s current state, highlighting stocks that are moving significantly in either direction. This visual representation, using color gradients to represent price changes, allows investors to quickly identify stocks experiencing notable gains or losses.

Decoding the Heatmap: A Visual Guide to Market Dynamics

The Nasdaq Heatmap typically employs a color scheme where green represents increasing stock prices, red signifies declining prices, and a neutral color, often gray, indicates no significant change. The intensity of the color corresponds to the magnitude of the price movement. For example, a deep green indicates a substantial increase in price, while a light green suggests a more modest rise.

The Heatmap is typically structured in a grid format, with each row representing a specific sector and each column representing a particular stock. This layout facilitates a quick and efficient understanding of market trends across various sectors.

Beyond Color: Unveiling Key Data Points

While the color scheme provides a visual overview, the Heatmap also presents crucial data points for each stock, including:

- Symbol: The unique identifier for each stock.

- Last: The most recent trading price of the stock.

- Change: The difference between the current price and the previous closing price.

- Percent Change: The percentage change in price relative to the previous closing price.

- Volume: The number of shares traded during the current trading session.

These data points, combined with the color-coded representation, provide a comprehensive overview of the stock’s performance and market activity.

The Benefits of Utilizing the Nasdaq Heatmap

The Nasdaq Heatmap offers a range of benefits for investors, traders, and financial analysts:

- Efficient Market Scanning: The Heatmap allows users to quickly identify stocks with significant price movements, enabling them to focus their analysis on potentially high-impact opportunities.

- Sector-Specific Insights: The Heatmap’s sector-based organization facilitates a rapid assessment of market trends across different industries. This allows investors to identify sectors experiencing strong or weak performance, providing valuable insights for portfolio allocation strategies.

- Real-Time Market Monitoring: The Heatmap provides a dynamic and real-time view of market activity, offering a continuous stream of data that helps investors stay informed of the latest market developments.

- Enhanced Trading Decisions: By understanding the market’s current state and identifying stocks with significant price movements, the Heatmap aids in making more informed trading decisions.

- Improved Risk Management: The Heatmap helps investors identify stocks with potentially high volatility, allowing them to assess and manage risk effectively.

Frequently Asked Questions about the Nasdaq Heatmap

Q: How often is the Nasdaq Heatmap updated?

A: The Nasdaq Heatmap is typically updated in real-time, reflecting the latest market activity.

Q: Is the Nasdaq Heatmap available for free?

A: Many financial websites and platforms offer free access to the Nasdaq Heatmap. However, some platforms may offer premium versions with additional features and functionalities.

Q: What are some of the limitations of the Nasdaq Heatmap?

A: The Nasdaq Heatmap primarily focuses on the Nasdaq Stock Market, limiting its scope to a specific set of stocks. It also relies on historical data and past performance, which may not always accurately predict future market trends.

Tips for Effectively Utilizing the Nasdaq Heatmap

- Combine with Fundamental Analysis: The Heatmap provides a valuable snapshot of market activity, but it should be used in conjunction with fundamental analysis to gain a complete understanding of a stock’s underlying value.

- Consider Market Context: The Heatmap should be interpreted within the broader market context, taking into account factors such as economic indicators, geopolitical events, and industry trends.

- Focus on Specific Sectors: Instead of analyzing the entire Heatmap, focus on specific sectors that align with your investment objectives or areas of expertise.

- Use Filtering Options: Many platforms offer filtering options to narrow down the Heatmap to specific criteria, such as price change, volume, or sector.

- Monitor Over Time: The Heatmap is a dynamic tool that should be monitored over time to identify emerging trends and potential opportunities.

Conclusion

The Nasdaq Heatmap is a valuable tool for investors seeking to navigate the complex and dynamic financial market. By providing a visual representation of market activity, it offers insights into stock performance, sector trends, and potential investment opportunities. While the Heatmap should be used in conjunction with other analytical tools and market knowledge, it offers a powerful starting point for informed investment decisions. As the financial world continues to evolve, the Nasdaq Heatmap remains a vital resource for investors seeking to stay ahead of the curve and capitalize on emerging market opportunities.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Market Landscape: Understanding the Nasdaq Heatmap. We hope you find this article informative and beneficial. See you in our next article!