Navigating the Landscape of Berks County: A Comprehensive Guide to the County Tax Map

Related Articles: Navigating the Landscape of Berks County: A Comprehensive Guide to the County Tax Map

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape of Berks County: A Comprehensive Guide to the County Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Berks County: A Comprehensive Guide to the County Tax Map

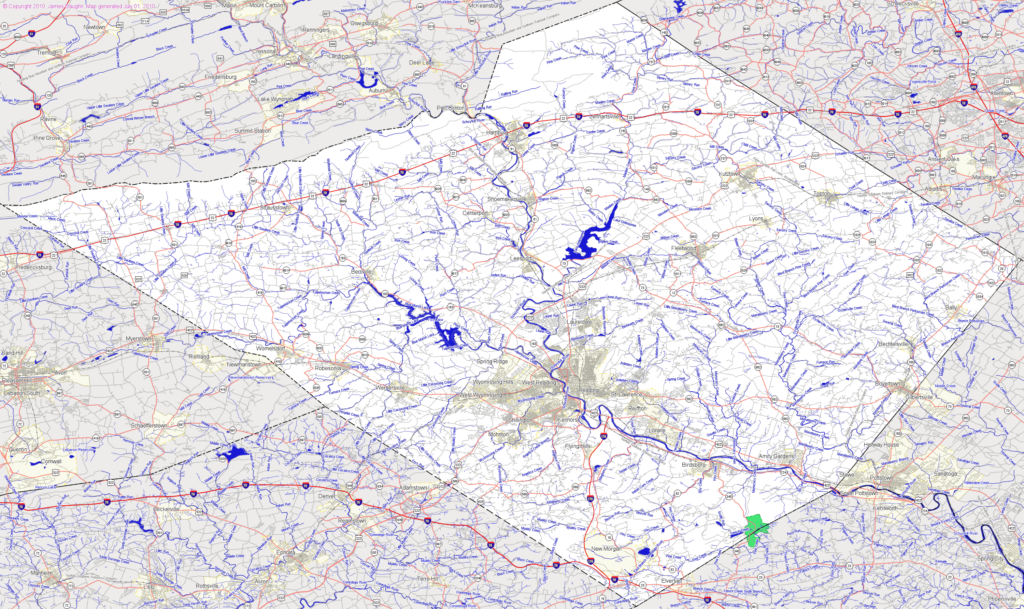

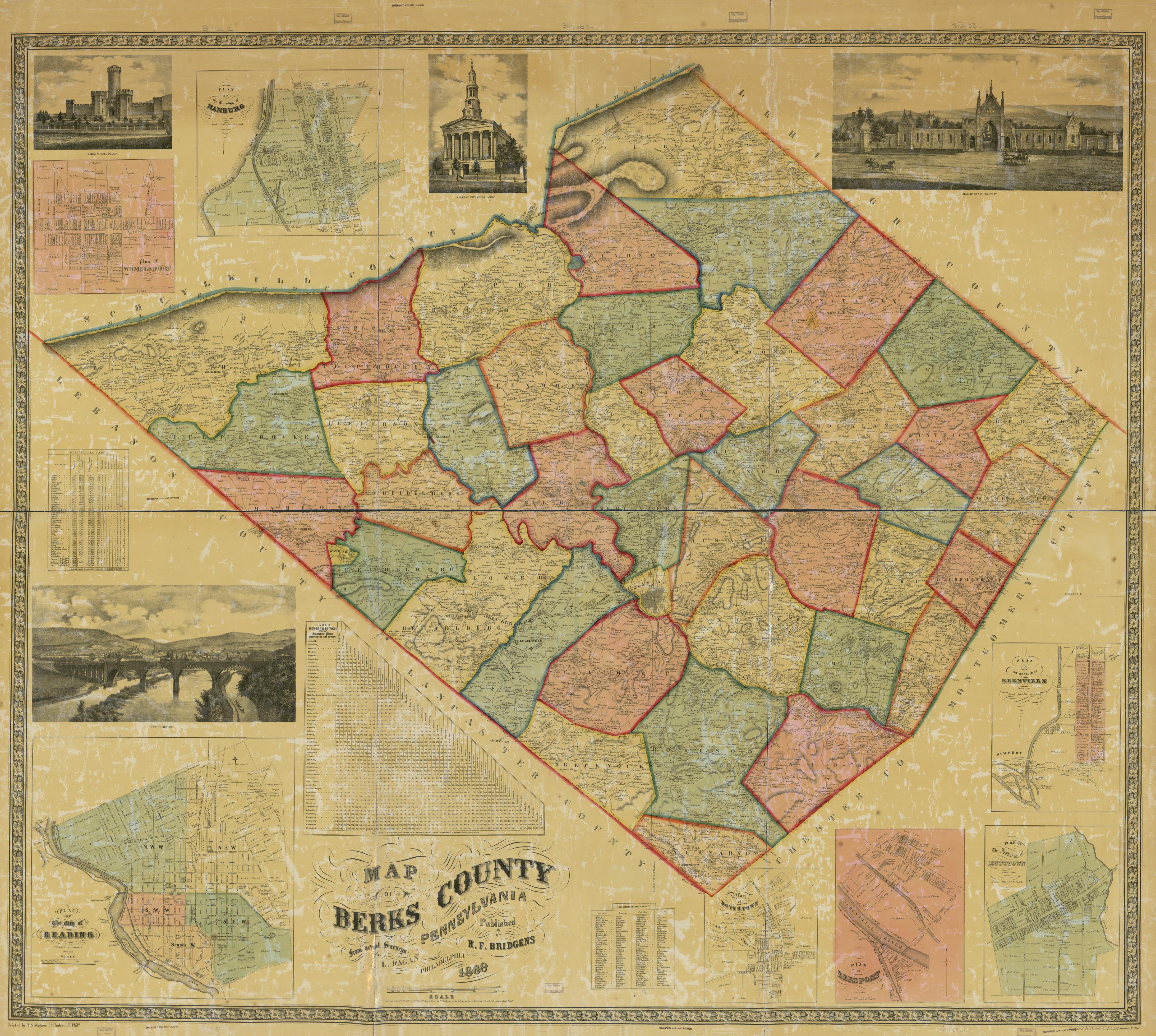

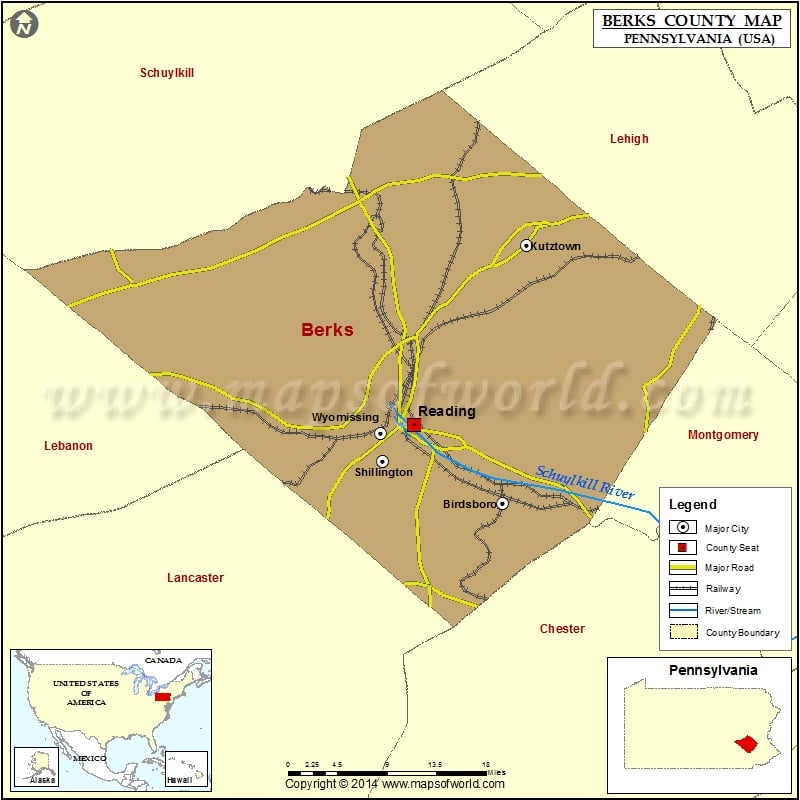

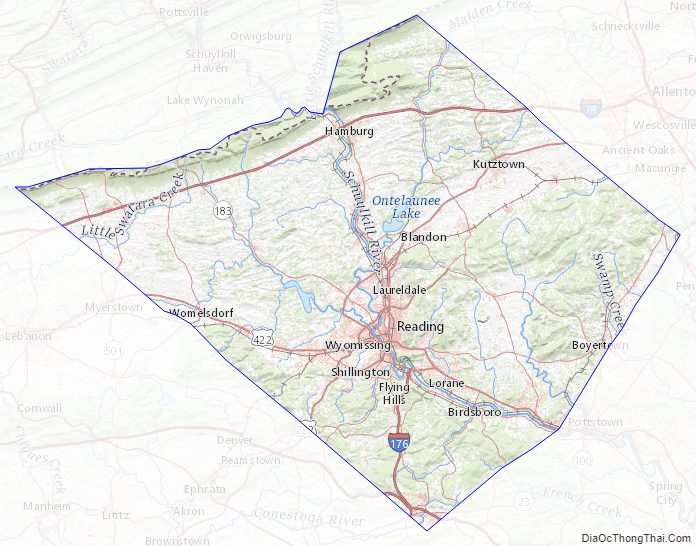

Berks County, Pennsylvania, a vibrant tapestry of urban and rural communities, is home to a diverse population and a rich history. This dynamic landscape, however, requires a structured approach to managing its resources, particularly when it comes to property taxation. The Berks County Tax Map serves as the essential blueprint for this intricate process, providing a clear and detailed visual representation of the county’s properties, their boundaries, and their assigned tax parcels.

Understanding the Basics: A Visual Guide to Property Ownership

The Berks County Tax Map is not merely a static image; it is a dynamic tool that constantly evolves to reflect the ever-changing landscape of property ownership. This map, maintained by the Berks County Assessment Office, serves as the official record of every property within the county’s boundaries. It is a valuable resource for various stakeholders, including:

- Property Owners: The map provides a clear visual representation of their property’s boundaries, ensuring accurate assessment and tax calculations.

- Real Estate Professionals: Agents and brokers rely on the map to understand property locations, assess market values, and assist clients in making informed decisions.

- Government Agencies: The map is crucial for planning and development initiatives, ensuring efficient allocation of resources and equitable tax distribution.

- Lenders and Investors: The map provides valuable insights into property ownership, helping them make informed decisions about financing or investing in Berks County properties.

The Anatomy of the Map: A Detailed Look at its Components

The Berks County Tax Map is a meticulously crafted document, composed of several key elements that work together to provide a comprehensive picture of property ownership:

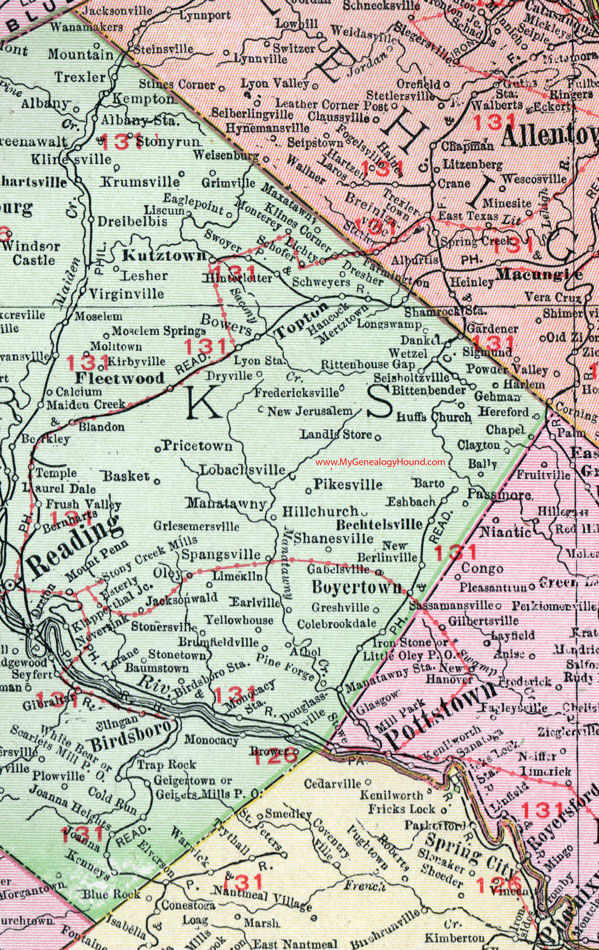

- Parcel Numbers: Each property within the county is assigned a unique parcel number, serving as its primary identifier. This number allows for accurate tracking and identification of properties for tax purposes.

- Property Boundaries: The map clearly delineates the boundaries of each property, using lines and markers to represent fences, roads, and other physical features. This ensures accurate measurement and avoids disputes over property ownership.

- Property Attributes: The map includes key information about each property, such as its address, size, zoning classification, and any existing easements or restrictions. This information is vital for understanding the property’s potential uses and limitations.

- Land Use Categories: The map categorizes properties based on their primary use, such as residential, commercial, industrial, or agricultural. This allows for targeted tax assessments and ensures fairness in the tax system.

- Tax Rates and Assessments: The map is linked to the county’s tax database, providing access to information about property assessments, tax rates, and tax bills. This transparency empowers property owners to understand their tax obligations.

Beyond the Map: Exploring Additional Resources

The Berks County Tax Map is the foundation for a comprehensive system of property information and management. It is complemented by a range of additional resources that provide further insights into the county’s property landscape:

- Berks County Assessment Office Website: The official website offers online access to tax maps, property assessment data, and other relevant information. This digital platform provides convenience and accessibility for property owners and stakeholders.

- County GIS (Geographic Information System): This advanced system integrates the tax map with other spatial data, allowing for detailed analysis and visualization of property information. This tool is invaluable for planning and development initiatives.

- Public Records: The county maintains public records related to property ownership, including deeds, mortgages, and other legal documents. These records provide a comprehensive historical perspective on property transactions.

FAQs: Addressing Common Questions about the Berks County Tax Map

Q: How can I access the Berks County Tax Map?

A: The map is available online through the Berks County Assessment Office website. You can search for specific properties by address or parcel number.

Q: How often is the map updated?

A: The map is updated regularly to reflect changes in property ownership, boundaries, and other relevant information. The Assessment Office maintains a schedule for these updates, ensuring the map remains accurate and current.

Q: Can I use the map for personal purposes, such as planning a home renovation?

A: The map can be a helpful tool for planning purposes, but it is essential to consult with a qualified professional for specific project requirements.

Q: What happens if there is an error on the map?

A: If you believe there is an error on the map, contact the Berks County Assessment Office to report the issue. They will investigate and make necessary corrections.

Tips for Effective Use of the Berks County Tax Map

- Utilize the online search tools: The Assessment Office website provides efficient search functions to quickly locate properties and access their information.

- Familiarize yourself with the map’s legend: Understanding the symbols and colors used on the map is crucial for accurate interpretation of property information.

- Contact the Assessment Office for assistance: If you encounter any difficulties navigating the map or accessing information, don’t hesitate to reach out for support.

- Stay informed about updates: The Assessment Office periodically updates the map, so it’s beneficial to check for any recent changes.

Conclusion: A Vital Tool for Navigating the Berks County Landscape

The Berks County Tax Map serves as a cornerstone for managing property ownership and ensuring equitable taxation. Its detailed visual representation, coupled with its comprehensive data, provides valuable insights for property owners, real estate professionals, government agencies, and other stakeholders. By understanding the map’s features and utilizing its resources, individuals and organizations can navigate the complexities of property ownership and contribute to the continued growth and development of Berks County.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Berks County: A Comprehensive Guide to the County Tax Map. We appreciate your attention to our article. See you in our next article!