Navigating Nassau County: Understanding the Tax Map and its Importance

Related Articles: Navigating Nassau County: Understanding the Tax Map and its Importance

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Nassau County: Understanding the Tax Map and its Importance. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Nassau County: Understanding the Tax Map and its Importance

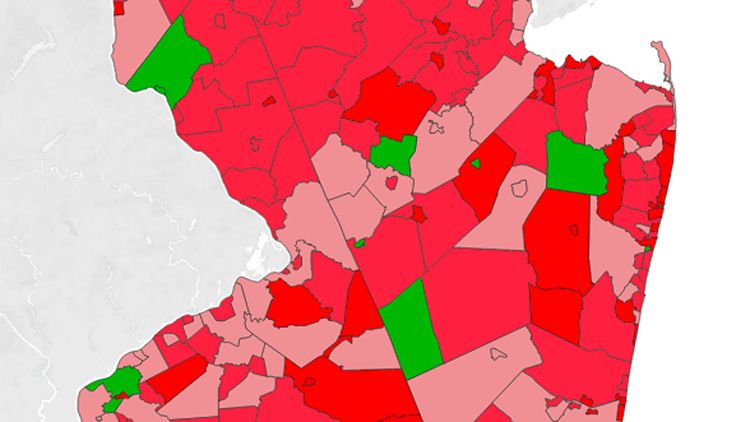

Nassau County, New York, boasts a diverse landscape, encompassing bustling urban centers, tranquil suburban neighborhoods, and picturesque coastal areas. This intricate tapestry of communities is meticulously documented and organized through a comprehensive system known as the Nassau County Tax Map. This vital tool serves as a blueprint for the county, providing a detailed and standardized method for identifying and classifying every parcel of land within its boundaries.

A Foundation of Information:

The Nassau County Tax Map is a complex yet essential system that plays a crucial role in various aspects of county administration, property ownership, and public services. It is a highly detailed and standardized representation of the county’s real estate, incorporating information about:

- Parcel Boundaries: The map defines the precise boundaries of each individual property, ensuring accurate identification and delineation. This information is crucial for legal purposes, property transactions, and land use planning.

- Property Features: The tax map includes information about the physical characteristics of each parcel, including its size, shape, and any existing structures. This data is essential for assessing property value, determining zoning regulations, and facilitating infrastructure development.

- Ownership Information: The tax map maintains a record of the current owner of each parcel, providing a readily accessible source of ownership information for various purposes, including property taxes, legal proceedings, and real estate transactions.

- Tax Assessment: The tax map serves as the foundation for determining the assessed value of each property, which in turn determines the amount of property taxes owed to the county. This information is essential for equitable taxation and revenue generation.

Navigating the Map:

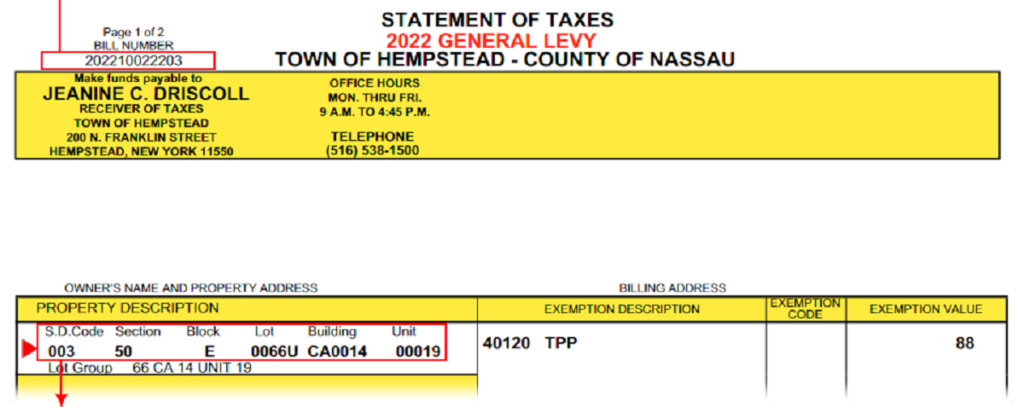

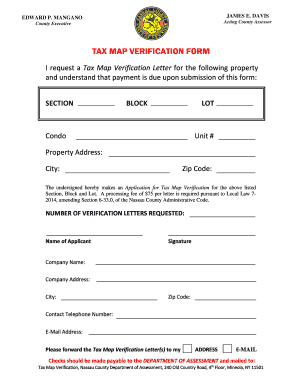

The Nassau County Tax Map is organized into a grid system, with each section identified by a unique combination of letters and numbers. This grid system simplifies the process of locating specific parcels, ensuring clarity and consistency.

- Section Numbers: The map is divided into sections, each designated by a unique number. These sections correspond to geographical areas within the county, facilitating easy navigation and identification.

- Block Numbers: Within each section, parcels are further organized into blocks, each identified by a unique number. This hierarchical system allows for efficient identification and retrieval of specific parcels.

- Lot Numbers: Individual parcels within each block are assigned unique lot numbers, providing a final layer of identification and ensuring precise referencing of each property.

Benefits of the Tax Map:

The Nassau County Tax Map offers a multitude of benefits, streamlining various processes and providing valuable information for a wide range of stakeholders.

- Property Transactions: The tax map facilitates smooth and accurate property transactions, ensuring that buyers and sellers have access to essential information about the property, including its boundaries, ownership, and assessed value.

- Land Use Planning: The detailed information provided by the tax map is essential for effective land use planning, enabling officials to make informed decisions about zoning, development, and infrastructure projects.

- Tax Assessment: The tax map provides a standardized framework for property assessment, ensuring fairness and transparency in the tax system. This information is crucial for equitable distribution of the tax burden and revenue generation.

- Emergency Services: The tax map is a valuable resource for emergency responders, providing accurate information about property boundaries, access points, and potential hazards. This information is crucial for efficient response and resource allocation during emergencies.

- Public Services: The tax map facilitates the delivery of public services, such as water and sewer, by providing accurate information about property locations and infrastructure needs.

Understanding the System:

The Nassau County Tax Map is a complex system, but understanding its structure and functionality is crucial for anyone involved in property ownership, real estate transactions, or public services.

- Access and Availability: The tax map is publicly accessible through various channels, including the Nassau County Department of Assessment’s website and physical offices.

- Online Resources: The Department of Assessment provides online tools and resources, including interactive maps and searchable databases, to assist users in navigating the tax map system.

- Professional Assistance: Real estate professionals, surveyors, and legal experts can provide guidance and support in interpreting and utilizing the tax map for specific needs.

FAQs about the Nassau County Tax Map:

1. What is the purpose of the Nassau County Tax Map?

The Nassau County Tax Map serves as a comprehensive and standardized representation of all real estate parcels within the county, providing essential information for property identification, ownership, assessment, and land use planning.

2. How can I access the Nassau County Tax Map?

The Nassau County Tax Map is publicly accessible through the Department of Assessment’s website and physical offices. Online resources include interactive maps and searchable databases.

3. How is the Nassau County Tax Map organized?

The tax map is organized into a grid system, with sections, blocks, and lots, providing a hierarchical structure for identifying specific parcels.

4. What information is included in the Nassau County Tax Map?

The tax map includes information about parcel boundaries, property features, ownership information, and tax assessment data.

5. How can I use the Nassau County Tax Map to find a specific property?

You can search for a specific property using the online resources provided by the Department of Assessment, including interactive maps and searchable databases.

6. Can I use the Nassau County Tax Map for real estate transactions?

Yes, the tax map is an essential tool for real estate transactions, providing accurate information about property boundaries, ownership, and assessed value.

7. How is the Nassau County Tax Map used for land use planning?

The tax map provides detailed information about property characteristics and boundaries, enabling officials to make informed decisions about zoning, development, and infrastructure projects.

8. How does the Nassau County Tax Map affect property taxes?

The tax map is used to determine the assessed value of each property, which in turn determines the amount of property taxes owed to the county.

9. What are the benefits of using the Nassau County Tax Map?

The tax map streamlines property transactions, facilitates land use planning, ensures equitable taxation, assists emergency services, and supports the delivery of public services.

10. Is there any cost associated with accessing the Nassau County Tax Map?

Accessing the tax map through the Department of Assessment’s website is generally free of charge. However, certain services, such as obtaining official copies of maps or records, may incur a fee.

Tips for Utilizing the Nassau County Tax Map:

- Familiarize yourself with the grid system: Understand how sections, blocks, and lots are organized to effectively navigate the map.

- Utilize online resources: Take advantage of the interactive maps and searchable databases provided by the Department of Assessment.

- Consult with professionals: If you require assistance interpreting the tax map or using it for specific purposes, seek guidance from real estate professionals, surveyors, or legal experts.

- Keep records updated: Regularly check for updates to the tax map, ensuring that your information is accurate and up-to-date.

Conclusion:

The Nassau County Tax Map is a vital resource for navigating the county’s intricate landscape. It serves as a foundation for property ownership, land use planning, tax assessment, and the delivery of public services. By understanding the structure, functionality, and benefits of the tax map, individuals and organizations can effectively leverage this system to navigate property transactions, make informed decisions, and ensure efficient and equitable administration of the county’s resources.

Closure

Thus, we hope this article has provided valuable insights into Navigating Nassau County: Understanding the Tax Map and its Importance. We thank you for taking the time to read this article. See you in our next article!