Decoding the Network: A Comprehensive Guide to the Federal Reserve System’s Geographic Structure

Related Articles: Decoding the Network: A Comprehensive Guide to the Federal Reserve System’s Geographic Structure

Introduction

With great pleasure, we will explore the intriguing topic related to Decoding the Network: A Comprehensive Guide to the Federal Reserve System’s Geographic Structure. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Decoding the Network: A Comprehensive Guide to the Federal Reserve System’s Geographic Structure

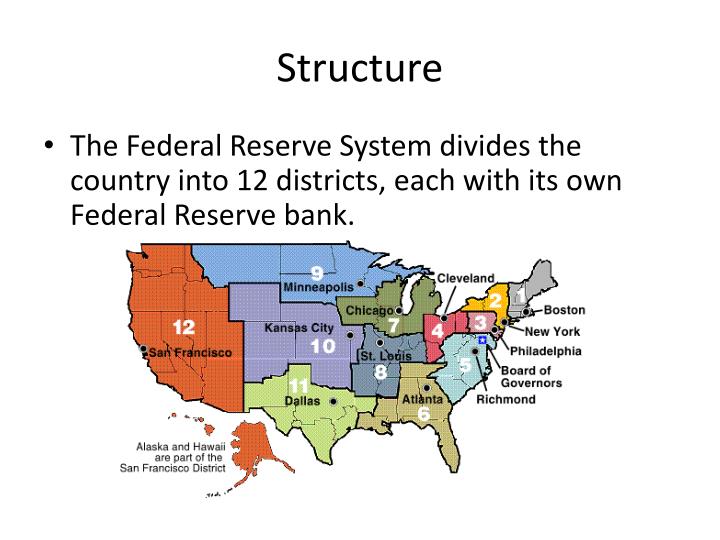

The Federal Reserve System, often referred to as the Fed, is the central bank of the United States. It plays a crucial role in maintaining the stability of the nation’s financial system and promoting economic growth. One key aspect of the Fed’s structure is its decentralized geographic organization, represented by a network of twelve regional Federal Reserve Banks.

A Nationally Integrated Network:

The map of Federal Reserve Banks visually depicts this network, showcasing twelve distinct regional banks strategically positioned across the country. Each bank serves a specific geographic area, known as a Federal Reserve District. These districts are designed to encompass major economic centers and ensure that the Fed’s policies are tailored to the unique needs of each region.

Understanding the Districts:

- District 1: Boston – Encompassing Maine, Vermont, New Hampshire, Massachusetts, Rhode Island, and Connecticut.

- District 2: New York – Covering New York State and northern New Jersey.

- District 3: Philadelphia – Including Pennsylvania, Delaware, southern New Jersey, and parts of Maryland.

- District 4: Cleveland – Serving Ohio, western Pennsylvania, eastern Kentucky, and northern West Virginia.

- District 5: Richmond – Covering Virginia, North Carolina, South Carolina, Maryland, and the District of Columbia.

- District 6: Atlanta – Encompassing Georgia, Florida, Alabama, and parts of Mississippi, Louisiana, and Tennessee.

- District 7: Chicago – Serving Illinois, Indiana, Wisconsin, northern Michigan, and parts of Iowa and Missouri.

- District 8: St. Louis – Covering Missouri, Arkansas, Tennessee, southern Illinois, eastern Oklahoma, and northern Mississippi.

- District 9: Minneapolis – Serving Minnesota, Montana, North Dakota, South Dakota, and parts of Wisconsin and Michigan.

- District 10: Kansas City – Encompassing Kansas, Nebraska, Wyoming, Colorado, Oklahoma, and parts of Missouri.

- District 11: Dallas – Covering Texas, New Mexico, and parts of Louisiana and Oklahoma.

- District 12: San Francisco – Serving California, Nevada, Arizona, Hawaii, Alaska, and parts of Oregon and Washington.

Beyond the Map: The Functional Roles of the Federal Reserve Banks

The map provides a visual representation of the geographic structure of the Federal Reserve System, but it’s crucial to understand the functional roles of each regional bank. They are not simply branches of a centralized institution but operate as semi-autonomous entities with specific responsibilities. These responsibilities encompass:

- Providing Financial Services to Banks: Regional banks serve as financial intermediaries for banks within their districts. They provide loans, clear checks, and manage electronic payments, ensuring the smooth functioning of the banking system.

- Supervising and Regulating Banks: The Fed is responsible for maintaining the stability of the financial system. Regional banks play a crucial role in supervising and regulating banks within their districts, ensuring they operate safely and prudently.

- Collecting and Analyzing Economic Data: Each regional bank collects and analyzes economic data specific to its district, offering valuable insights into regional economic trends. This information helps the Federal Reserve Board in Washington, D.C., make informed decisions about monetary policy.

- Conducting Research and Public Education: Regional banks conduct research on a wide range of economic issues and provide public education on financial matters, contributing to the understanding of the economy and the Fed’s role within it.

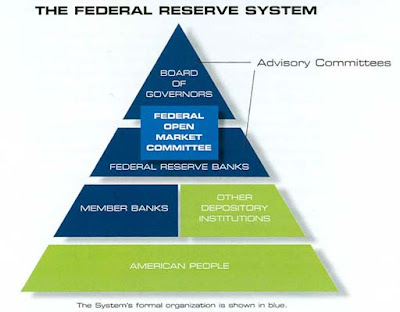

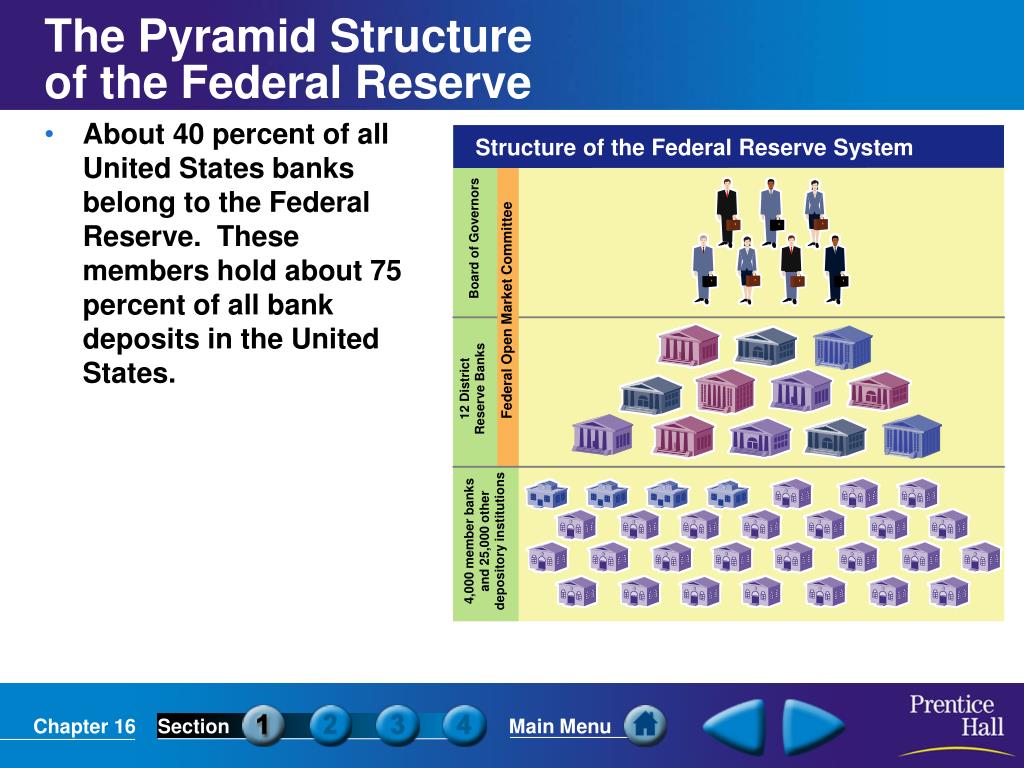

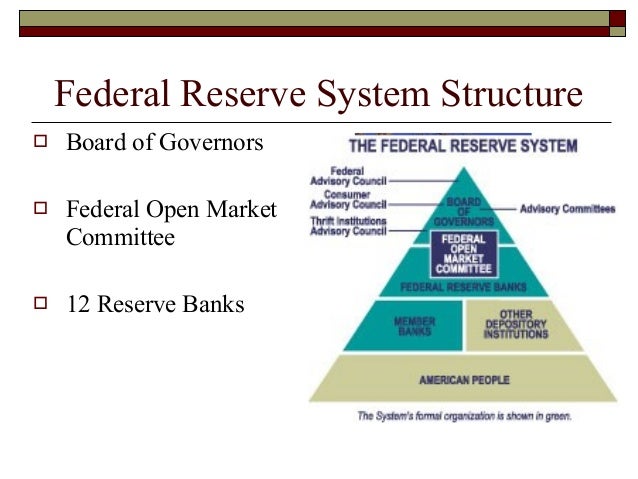

The Board of Governors: Centralizing Policy and Oversight

While the regional banks have their own unique responsibilities, they are ultimately overseen by the Board of Governors, located in Washington, D.C. The Board is comprised of seven members appointed by the President and confirmed by the Senate. The Board sets the overall direction for monetary policy and provides guidance to the regional banks.

The Federal Open Market Committee: Setting Interest Rates

A key responsibility of the Federal Reserve is setting interest rates, which directly impacts the cost of borrowing and lending in the economy. This crucial task is carried out by the Federal Open Market Committee (FOMC), composed of the seven members of the Board of Governors and five presidents of the regional banks on a rotating basis. The FOMC meets eight times a year to discuss and decide on monetary policy, including setting the federal funds rate, which is the interest rate banks charge each other for overnight loans.

Importance of the Geographic Structure

The decentralized structure of the Federal Reserve System, as depicted by the map, offers several benefits:

- Regional Expertise: Each regional bank possesses specialized knowledge about the economic conditions and financial markets within its district. This localized expertise allows the Fed to tailor its policies to the specific needs of different regions.

- Flexibility and Responsiveness: The decentralized structure enables the Fed to respond quickly and effectively to regional economic shocks. Regional banks can implement policies locally, addressing specific concerns without waiting for approval from a centralized authority.

- Checks and Balances: The decentralized structure promotes a system of checks and balances, ensuring that no single entity has absolute control over monetary policy. This helps prevent the potential for abuse or misuse of power.

FAQs about the Federal Reserve System’s Geographic Structure

Q: Why is the Federal Reserve System organized into twelve districts?

A: The twelve-district structure was designed to ensure that the Fed’s policies are tailored to the unique needs of different regions across the country. Each district encompasses major economic centers, allowing the Fed to collect and analyze regional economic data and provide financial services to banks in a more localized and responsive manner.

Q: How are the presidents of the regional banks chosen?

A: The presidents of the regional banks are appointed by the boards of directors of their respective banks, subject to approval by the Board of Governors. The boards of directors are comprised of individuals from the private sector and the public sector, ensuring a diverse perspective in the selection process.

Q: What is the role of the Federal Open Market Committee (FOMC)?

A: The FOMC is responsible for setting the federal funds rate, which is the interest rate banks charge each other for overnight loans. The FOMC meets eight times a year to discuss and decide on monetary policy, influencing the overall cost of borrowing and lending in the economy.

Q: How does the Federal Reserve System contribute to economic stability?

A: The Fed promotes economic stability through its role in setting interest rates, regulating banks, and providing financial services to the banking system. By controlling the money supply and ensuring the stability of the financial system, the Fed helps to prevent inflation, promote economic growth, and maintain a healthy financial environment.

Tips for Understanding the Federal Reserve System’s Geographic Structure

- Use the map as a visual guide: The map of Federal Reserve Banks provides a clear representation of the geographic structure of the system. Studying the map can help you understand the locations of the regional banks and the areas they serve.

- Research the specific responsibilities of each regional bank: Each bank has unique responsibilities tailored to its district. Explore their websites and publications to gain a deeper understanding of their roles and activities.

- Follow the Fed’s publications and announcements: The Federal Reserve regularly publishes reports, speeches, and other materials that provide insights into its policies and decisions. Staying informed about these publications can help you stay abreast of current economic developments and the Fed’s response to them.

- Engage in discussions and debates: Participate in discussions and debates about the Fed’s policies and the impact of its decisions on the economy. This can help you develop a more nuanced understanding of the complexities of the Federal Reserve System.

Conclusion

The map of Federal Reserve Banks serves as a visual representation of a complex and vital institution that plays a crucial role in shaping the U.S. economy. It highlights the decentralized structure of the Federal Reserve System, emphasizing the importance of regional expertise, flexibility, and a system of checks and balances in maintaining economic stability. Understanding the geographic structure of the Fed, along with its various functions and responsibilities, is essential for comprehending the intricate workings of the nation’s financial system and its impact on our daily lives.

Closure

Thus, we hope this article has provided valuable insights into Decoding the Network: A Comprehensive Guide to the Federal Reserve System’s Geographic Structure. We hope you find this article informative and beneficial. See you in our next article!